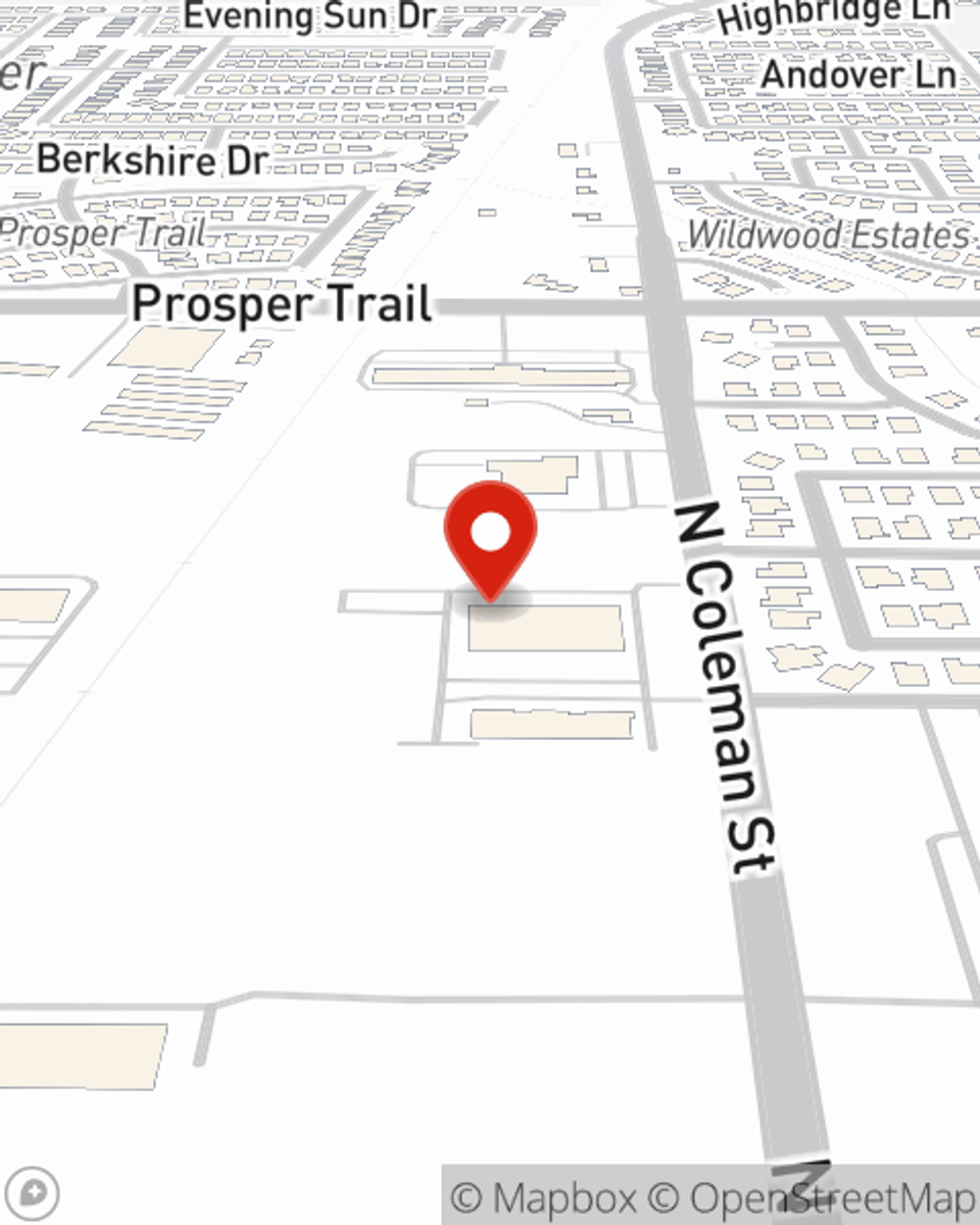

Business Insurance in and around Prosper

One of the top small business insurance companies in Prosper, and beyond.

Almost 100 years of helping small businesses

Cost Effective Insurance For Your Business.

Owning a business is about more than making a profit. It’s a lifestyle and a way of life. It's a commitment to a bright future for you and for everyone you care for. Because you give every effort to make your business thrive, you’ll want small business insurance from State Farm. Business insurance protects all your hard work with errors and omissions liability, business continuity plans and extra liability coverage.

One of the top small business insurance companies in Prosper, and beyond.

Almost 100 years of helping small businesses

Get Down To Business With State Farm

Whether you own a barber shop, a clock shop or a HVAC company, State Farm is here to help. Aside from remarkable service all around, you can customize a policy to fit your business's specific needs. It's no wonder other business owners choose State Farm for their business insurance.

Reach out agent Christian Lett to discuss your small business coverage options today.

Simple Insights®

Tenant small business

Tenant small business

As you get ready to rent space for your business, there are considerations to keep in mind.

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.

Christian Lett

State Farm® Insurance AgentSimple Insights®

Tenant small business

Tenant small business

As you get ready to rent space for your business, there are considerations to keep in mind.

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.