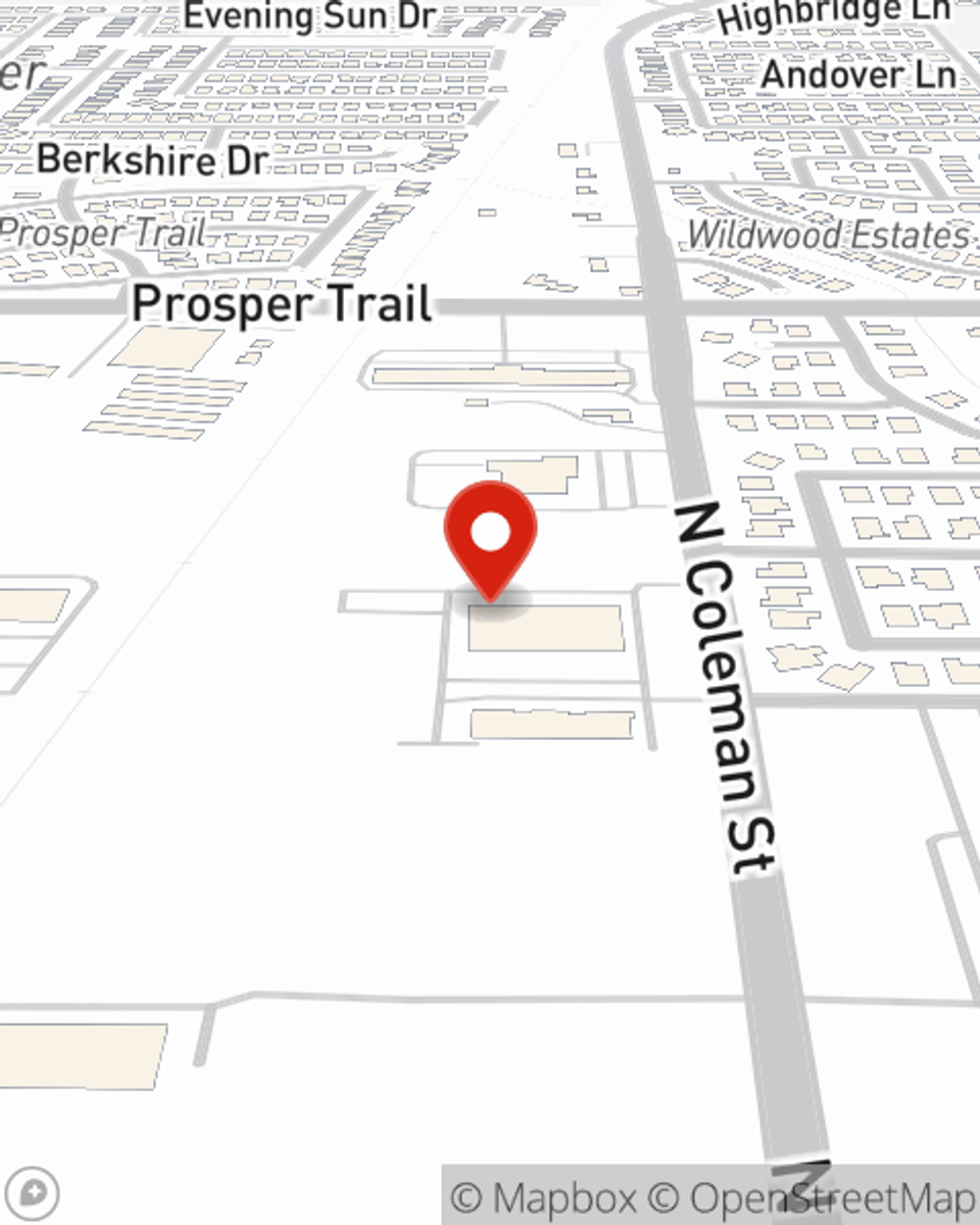

Homeowners Insurance in and around Prosper

Protect what's important from disaster.

Give your home an extra layer of protection with State Farm home insurance.

Would you like to create a personalized homeowners quote?

What's More Important Than A Secure Home?

One of the most important actions you can take for your loved ones is to get homeowners insurance through State Farm. This way you can unwind knowing that your home is covered.

Protect what's important from disaster.

Give your home an extra layer of protection with State Farm home insurance.

Agent Christian Lett, At Your Service

From your home to your cherished hobbies, State Farm can help you protect what you value most. Christian Lett would love to help you understand your options.

When your Prosper, TX, residence is insured by State Farm, even if something bad does happen, your home may be covered! Call or go online today and find out how State Farm agent Christian Lett can help meet your home insurance needs.

Have More Questions About Homeowners Insurance?

Call Christian at (972) 346-1638 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Home safety checklist

Home safety checklist

Consider these home safety measures to help prevent common household injuries.

How long can kids stay on parent’s insurance?

How long can kids stay on parent’s insurance?

Learn when a child can transition from their parent’s insurance to their own by understanding various insurance coverage guidelines.

Christian Lett

State Farm® Insurance AgentSimple Insights®

Home safety checklist

Home safety checklist

Consider these home safety measures to help prevent common household injuries.

How long can kids stay on parent’s insurance?

How long can kids stay on parent’s insurance?

Learn when a child can transition from their parent’s insurance to their own by understanding various insurance coverage guidelines.